AI scalability modeling for brokerages transforms commercial real estate (CRE) market analysis by processing vast historical data and complex variables like economic indicators and social media sentiment. This technology predicts occupancy rates accurately, aiding strategic decisions on investments, leasing, and property acquisitions in a dynamic CRE landscape. Advanced AI models adapt to changing trends, empowering brokerages with efficient tools to stay competitive and make informed choices.

In today’s data-driven landscape, Artificial Intelligence (AI) is transforming commercial real estate (CRE) occupancy rate forecasting. By understanding intricate CRE occupancy patterns, AI models powered by machine learning can predict future trends with remarkable accuracy. This article explores the strategic application of AI in CRE, focusing on scalable modeling solutions tailored for brokerage efficiency and growth. We delve into how these advanced algorithms enhance decision-making, optimize investment strategies, and drive success in a dynamic market.

- Understanding Commercial Real Estate Occupancy Patterns

- Leveraging AI for Accurate Forecasting Models

- Scaling AI Solutions for Brokerage Efficiency and Growth

Understanding Commercial Real Estate Occupancy Patterns

Commercial real estate (CRE) occupancy rates are influenced by a myriad of factors, from economic conditions to demographic shifts. Understanding these patterns is crucial for accurate forecasting. By leveraging AI scalability modeling for brokerages, it’s possible to analyze historical data on rental rates, vacancy trends, and tenant demographics to identify recurring themes and predict future demand.

This advanced approach goes beyond traditional methods by factoring in complex variables such as market sentiment, interest rates, and even social media sentiment. AI models can adapt to evolving market conditions, making them a powerful tool for CRE professionals aiming to stay ahead of the curve. This dynamic understanding allows for more informed decisions regarding property acquisitions, leasing strategies, and investment opportunities.

Leveraging AI for Accurate Forecasting Models

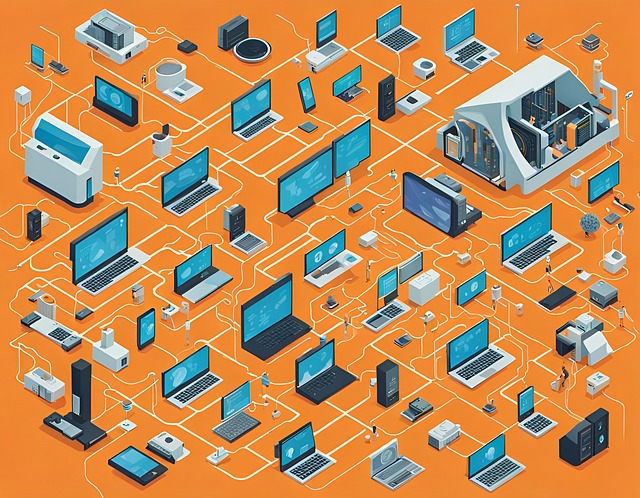

Leveraging AI for accurate forecasting models has become a game-changer in commercial real estate (CRE) occupancy rate prediction. Artificial intelligence, with its advanced algorithms and vast data processing capabilities, offers a scalable modeling solution for brokerages. This technology enables them to analyze complex market trends, historical data, and various macro-economic indicators to create precise forecasts.

AI scalability modeling allows for dynamic adjustments as market conditions evolve, ensuring that the forecasting system remains adaptable and reliable. By automating the data collection and analysis process, CRE professionals can save time and resources, enabling them to focus on strategic decision-making. This advanced approach enhances the accuracy of occupancy rate predictions, providing valuable insights for investors, developers, and brokers to make informed choices in a rapidly changing market.

Scaling AI Solutions for Brokerage Efficiency and Growth

As commercial real estate (CRE) markets become increasingly competitive, brokerage firms are recognizing the potential of AI scalability modeling to gain a significant edge. By implementing advanced AI solutions, brokerages can streamline their operations and offer more efficient services to clients. This technology enables them to process vast amounts of data, including market trends, property characteristics, and tenant information, to make informed decisions. With AI-driven models, brokerages can forecast occupancy rates with remarkable accuracy, allowing them to identify promising investment opportunities and optimize pricing strategies.

The scalability of AI in brokerage settings is a game-changer. As the volume of data grows, so does the need for robust systems that can handle complex analysis without compromising speed and efficiency. AI models can be designed to adapt and learn from new market dynamics, ensuring that brokerage firms stay ahead of the curve. This adaptability is crucial for keeping up with rapid changes in CRE trends, enabling brokers to provide up-to-date insights and strategies to their clients.

AI has the potential to revolutionize commercial real estate (CRE) occupancy rate forecasting by providing accurate, scalable modeling solutions. As seen in understanding CRE occupancy patterns and leveraging AI, these technologies can predict market trends and optimize brokerage operations. By embracing AI scalability, brokerages can enhance their decision-making processes, improve client services, and achieve sustainable growth in today’s competitive market.