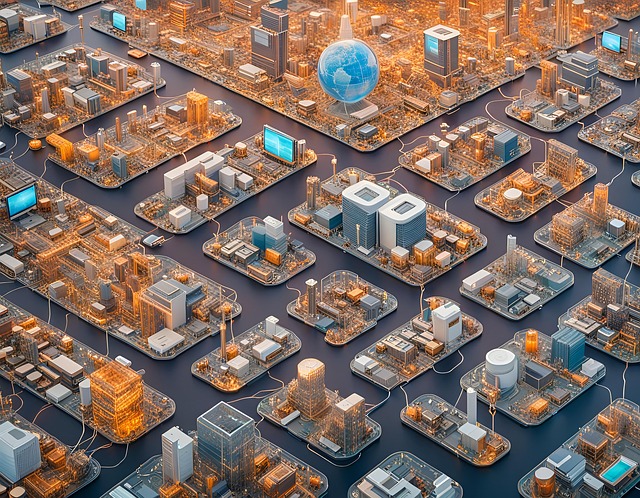

AI scalability modeling is transforming commercial real estate (CRE) portfolio management for brokerages, offering data-driven insights through advanced machine learning algorithms. These systems analyze vast datasets from diverse sources in real-time, uncovering market trends, property valuations, and investment returns with unmatched efficiency. Interactive dashboards enable users to swiftly evaluate portfolio health, make informed decisions, and personalize reporting for executives and investors. By leveraging AI scalability modeling, CRE brokerages can optimize investment strategies, enhance asset allocation, improve performance, and maintain their competitive edge in the dynamic market.

“Revolutionize your commercial real estate portfolio management with AI scalability modeling—the game-changer in brokerage operations. This article explores how dynamic dashboards can transform performance visualization, offering data-driven insights for informed decision-making. We delve into the process of building intelligent systems that adapt to market changes and scale brokerages’ analysis capabilities. By harnessing AI’s power, real estate professionals can navigate complex portfolios with ease, ensuring optimal investment strategies.”

- AI Scalability Modeling for Commercial Real Estate Portfolio Management

- Building Dynamic Dashboards to Visualize Performance Metrics

- Enhancing Brokerage Decision-Making with Data-Driven Insights

AI Scalability Modeling for Commercial Real Estate Portfolio Management

AI scalability modeling is transforming commercial real estate portfolio management, offering brokerages enhanced insights and predictive capabilities. By leveraging machine learning algorithms, AI systems can process vast amounts of data from various sources—market trends, property performance metrics, demographic shifts—to forecast future market conditions and optimize investment strategies. This enables brokerage firms to make more informed decisions regarding asset allocation, price setting, and tenant selection, ultimately driving better portfolio performance.

Furthermore, AI scalability modeling facilitates efficient portfolio monitoring and risk management. It allows for real-time tracking of key performance indicators (KPIs), such as occupancy rates, rental income, and property values, enabling proactive measures to mitigate risks and capitalize on emerging opportunities. As data becomes more abundant and complex, AI systems can scale to handle these growing demands, ensuring brokerages remain competitive in the dynamic commercial real estate market.

Building Dynamic Dashboards to Visualize Performance Metrics

In the realm of commercial real estate (CRE), building dynamic dashboards powered by AI represents a game-changer for brokerages seeking to optimize their portfolio performance. These cutting-edge tools utilize AI scalability modeling, enabling agents and investors to gain deep insights into market trends, property valuations, and investment returns with unparalleled efficiency. By processing vast datasets in real-time, AI algorithms can identify patterns and correlations that elude traditional analysis methods, providing a competitive edge.

Dynamic dashboards offer interactive visualizations of key performance indicators (KPIs), such as occupancy rates, rental income, and property values over time. This allows users to quickly assess the health of their portfolios and make data-driven decisions. Moreover, AI scalability modeling facilitates personalized reporting, catering to diverse stakeholder needs—from executives overseeing multiple properties to individual investors monitoring their holdings. This level of customization ensures that everyone involved has access to actionable intelligence tailored to their specific roles and interests.

Enhancing Brokerage Decision-Making with Data-Driven Insights

In today’s data-rich environment, commercial real estate (CRE) brokerages are recognizing the transformative power of AI and its potential to enhance decision-making processes. By implementing AI scalability modeling, brokerages can tap into a vast pool of data, from market trends to property performance metrics, providing them with valuable insights that were once challenging to access manually. This advanced approach allows for more precise predictions and improved strategies when evaluating investment opportunities and managing client portfolios.

Through AI-driven dashboards, brokerage professionals gain instant access to critical information, enabling them to make informed choices quickly. These tools can analyze historical data, identify patterns, and generate real-time performance reports, ensuring that every decision is data-backed. As a result, brokerages can optimize their CRE portfolio management, mitigate risks, and ultimately drive better outcomes for both clients and the business.

AI-powered dashboards are transforming commercial real estate portfolio management, offering unprecedented insights through AI scalability modeling. By visualizing performance metrics in dynamic, user-friendly interfaces, these tools empower brokerages to make data-driven decisions with greater speed and accuracy. From analyzing investment trends to optimizing asset allocation, AI commercial real estate dashboards revolutionize the industry, ensuring brokers stay ahead of the curve in today’s competitive market.